When Nigel Havers woke up on Friday morning, he thought the ‘remain’ vote (in the EU) would just ‘nick it’. Or so his mind games would have us believe. As the UK faces down the barrel of an abominable Boris Johnson Prime Ministership, we are left to search for the silver linings on some very dark and scary clouds.

Silver Lining #1: A Weak Pound Sterling

This is the most immediate and, publicised, effect. It reached a 30 year low (~$1.32 as of now) and it shows no signs of slowing down. Experts are predicting that it might reach $1.1-$1.2 by the end of the year.

This means that American travellers will get more bang for their buck at least in the short term. So, a trip to UK this year should be much easier on your wallet than before. Granted it might be even better next year, but remember, bird in hand and all…

Silver Lining #2: A Strong Dollar

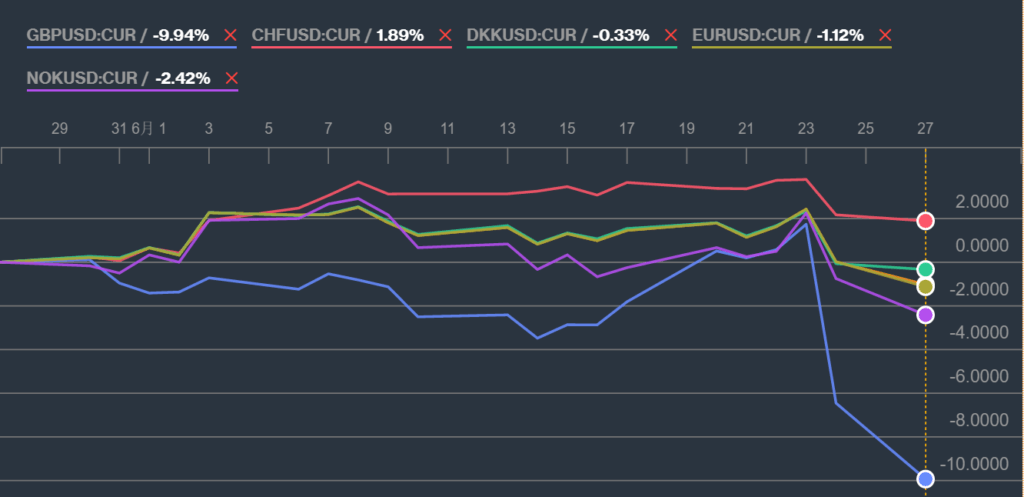

The uncertainties raised by BREXIT will also mean that people everywhere are going to run to the dollar. This will result in a strong dollar – bad for exports, good for international travel. The dollar has gained in strength against almost all currencies (except for a few like the Japanese Yen). And, as expected, it hits Europe hardest.

As you can see almost all European currencies have fallen against the US Dollar on Black Friday (June 23). This trend may continue but it is best to take advantage of favourable exchange rates when you see them. The Forex markets are quite volatile and you never know where they will be in a month from now.

Silver Lining #3: More enticing travel offers for Americans

It’s tough to see in the short term, but with BREXIT coming into effect, we may see a softening of the European economies. This might lead to a fall in the prices of hotels, restaurants, and other tourism related activities. Tourism is a major staple of European economies, and this will certainly force them to look for additional revenue from tourists across the seas.

Silver Lining # 4: It will take time

Remember that the BREXIT referendum vote is not binding. Any real impact probably won’t be realised for at least another two years and who knows how the political landscape will change in that time.

There are a few downsides for travellers as well:

Downside #1: Intra-European Airfares will Climb

The Open Skies Agreement, which governs the European aviation market will have to be renegotiated at a certain point within the next two years. This will result in higher airfares due to two reasons:

1.) Britain will have to pay a price to have the same access to the single European marketplace. Its carriers, mainly BA may have to pay extra for key landing slots. That price will be exacted upon the average air traveller in the form of taxes and fees.

2.) With the advent of a new agreement, Lufthansa and Air France may decide to pressure their respective governments to restrict EasyJet and Ryanair from operating certain routes or timings.

Downside #2: Longer lines at Immigration

If you have ever been to Britain, you know that immigration lines at Heathrow are a mess, and that EU citizens enjoy special “express” lanes to enter the UK. With Britain leaving the EU, those citizens may be directed into the same lanes, as the rest of us. You might as well, skip that quick overnight stopover in London.

Downside #3: Transatlantic airfares may also be at stake

We have no idea what kind of agreement, the U.S and the UK will arrive at in two years , but you can be sure the big 3 U.S carriers will try to push each other out of some desirable landing slots at Heathrow. The result may be reduced competition and higher airfares.

You can mark this story as developing……